History has seen many different industries make the transition from low volume and high cost to high volume and low cost. Ensuring product quality through such a transition is a difficult task.

When combined with the additional requirements imposed by space this transition becomes even more challenging. The space industry is in the midst of dramatic change. NewSpace is driving disruption that we haven’t seen since the original space race in the 1960’s. Business models are completely new. This article describes the challenges these unique business models place on electronic design, test strategies and processes. Presented are ways to enable much higher volume with far lower cost, all the while maintaining high quality.

This happens to be a most exciting time in the space business. The industry is energized and changing rapidly. The term NewSpace has emerged to describe these changes.

What is NewSpace?

NewSpace is an emerging global industry of private companies and entrepreneurs who primarily target commercial customers, are backed by risk capital seeking a return, and profit from innovative products or services developed in or for space.1

A huge number of Military, Aerospace and Government (MAG) entities as well as commercial companies are entering the space business. When NewSpace Global started in 2011, about 125 companies were being tracked. Now that number is well over 800, about 700 of which are privately held.

Most have seen the press coverage of SpaceX, OneWeb, Google and Facebook and their “change the world scale” plans for space. These companies will certainly drive disruptive change on a massive scale, but they are far from the only ones. Hundreds of other companies are getting into space with an amazingly wide variety of business models and mission types—from communications to earth imaging to weather forecasting to mining asteroids to interplanetary human existence.

However, the NewSpace movement is not limited to new entrants. Many established, traditional commercial space companies and MAG organizations are adapting and working to understand how best they can take advantage of the opportunities that all of this excitement presents. Alliances have been, and continue to be, formed between new entrants and established space players.

In many ways, NewSpace is not a new industry—this is a major disruptive force in the space industry, as a whole.

Electronic design and test are integral elements of spacecraft development. As NewSpace drives change in the space industry, the philosophies, strategies, processes and requirements associated with electronic design, development, production, test and measurement change as well.

This article describes NewSpace, contrast it with traditional space, and explore the implications for electronic design and test.

Industry Trends + Characteristics Of NewSpace

This is not your father’s space industry. NewSpace is a combination of Silicon Valley startup mentality meets space visionaries meets a good measure of traditional space experience.

Several business characteristics distinguish NewSpace from traditional space:

• Primary objective is to make a profit from an investment

• Commercial business and funding models

• Willingness to take risk

As these companies are primarily targeting commercial enterprise, commercial business principles apply. Accordingly, most NewSpace endeavors construct business models based on a level of investment, on-going cost structure, and revenue stream that results in a profitable outcome. Funding in NewSpace is coming from sources that historically have not been a part of the space industry.

The past several years have seen substantial venture capital investment in NewSpace endeavors. Crowd funding and angel investment are also playing a significant role. One of the most telling attributes of NewSpace is risk tolerance. Historically, with traditional space ventures risk is considered bad. As such, tremendous amounts of time, effort and expense are employed in an attempt to eliminate risk. Risk profiles in NewSpace are far different from those of traditional space. NewSpace companies are not foolhardy, but they understand that risk is something to be considered, assessed and managed.

Figure 1: Typical electronic product development cycle.

The level of risk tolerance varies significantly across companies and business models. The key is that risk is part of the business model to be managed - not some evil thing that must be eliminated at all cost. Many market and technical trends are enabling, or are associated

with, NewSpace:

• Rapid growth in the number of relatively low cost satellites

• Numerous deployments of satellite constellations

• Satellites with short orbital life expectancies

• Prolific use of commercial off-the-shelf (COTS) components

• Lower launch costs

• More frequent launches

• Increasing global competition

• Joint developments

• Hosted payloads

A critical attribute of the NewSpace movement is less expensive access to space. Lower launch costs are integral to many NewSpace business models.

For example, a company considering a satellite constellation may say, “If we can build N satellites for $X and launch them for $Y, our business model closes and we can make a viable business.”

Ride-sharing has emerged as a relatively low cost launch method for small satellites. While ridesharing is relatively inexpensive it does subject the secondary payload to the priorities of the primary. If the primary payload schedule slips, the secondary also slips.

Conversely, the primary is going to go... when it goes. If the secondary is not ready, the chance for launch is missed. Further launch cost reductions are in the works. SpaceX and others are championing the use of reusable boosters.

At the time of this writing, SpaceX had twice attempted landing the main stage booster of a Falcon 9 on a floating barge—close, but not quite. Certainly, they will eventually be successful.

Consistent reusability has the potential to reduce launch cost by an order of magnitude or more. Another trend focused on reducing launch cost, while eliminating the ride along issues, is dedicated small launch vehicles. A number of companies are developing launch vehicles specifically designed to deliver smaller payloads at lower price and higher launch frequency.

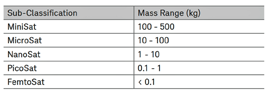

NewSpace has driven the emergence of low cost spacecraft, including the rapid growth of relatively low cost, small satellites (SmallSats). These range from extremely small (e.g., PocketQube at 150 g) to 500 kg. This is a wide range leading to further classification.

Table 1 shows the most common sub-classification of SmallSats. Specifically, the CubeSat has become a very popular standardized form-factor in the NanoSat class. Business models vary significantly across the classes.

While the trend is certainly to lower the cost of satellites, an opposing trend is that engineers are coming up with new, exciting and more complex missions for these satellites to attempt. In many cases, while costs need to go down, complexity is going up.

Figure 2: Flow for design and test process definition.

In addition to smaller size, the number of satellites associated with many NewSpace business models or missions is much larger than traditional space norms.

Many SmallSat businesses are planning to deploy large constellations—10’s, 100’s even 1000’s—of satellites. The majority of these are in Low Earth Orbit (LEO).

Intended mission lifetimes are much shorter than has historically been the case, where 15 years of life was common for most traditional satellites. For NewSpace, lifetimes of two to five years is becoming common and others possess even less of a lifetime.

These business models are based on the on-going presence of the constellation, so in order to sustain the business, the constellation needs to be regularly replenished. The large number of companies deploying constellations, the size of the constellations, and relatively short orbital lifetimes are combining to drive dramatic volume growth in SmallSat production. Industry estimates range from 2,500 to 4,000 new SmallSats on orbit between now and the close of this decade.

As many of these spacecraft are designed for shorter orbital lifetime and intended for LEO operation, where the radiation environment is relatively mild, the designs typically can be less robust than traditional satellites, particularly as compared to a geosynchronous satellite intended for a 15 year lifetime. This drives another key enabler of cost reduction for NewSpace—the use of commercial off-the-shelf (COTS) parts.

Historically, the space industry used predominantly (of-ten exclusively) space-qualified parts. COTS parts intended for terrestrial industries are far less expensive, more available, and typically further advanced in performance than space qualified parts.

Of course, the use of COTS parts also introduces risk. This is a key area where NewSpace calculates an acceptable level of risk to reduce cost and leverage advanced technologies.

NewSpace developers generally apply some level of qualification of COTS parts consistent with their mission, risk profile and business model. This effectively makes a COTS part “somewhat space qualified.” Similarly, automotive and industrial parts are widely used, as they are subject to a more rigorous qualification process than consumer electronics, but they are still far less expensive than space qualified.

Agile development processes have been widely used in the software industry. Agility has proven to be an effective approach, enabling rapid time-to-market processes. However, traditional space development much the antithesis of agile.

A number of NewSpace companies are employing agile methods to spacecraft development—develop, release, learn and iterate on quite short cycles—months rather than years. Several companies have extended agile methods into orbit—launching prototype capability, learning from the prototype on orbit, and feeding what has been learned back into the next revision.

Agile provides the opportunity to test elements of functionality and technology earlier than may be practical otherwise. For any given NewSpace mission and business model, agile methods may or may not be the best approach, but is certainly something worthy of consideration.

Business Challenges

The elements above provide great opportunity, but significant business challenges exist:

• Effective risk management

• Time-to-market and schedule pressure

• Expense and cost management

• Delivering volume in an industry not accustomed to it

• Need to continuously innovate

• Finding, attracting and keeping technical talent

With risk tolerance comes the requirement for an effective approach to risk management. A critical aspect of any commercial enterprise is understanding, assessment, analysis and management of risk including mitigation and contingency plans. NewSpace companies need to establish what risks they are willing and are not willing to take.

Schedule and time-to-market pressure are ever-present in the commercial and MAG worlds. This drives a shorter development lifecycle and creates pressure to deploy product sooner.

In NewSpace, schedule pressure is driven by the market as well as the desire to best the competition and may also be driven by the necessity to meet a specific launch window, or the need to push a new group of satellites into orbit to replace those that are approaching end-of-life in order to prevent disruption of the revenue stream.

Rockets and satellites have traditionally been a low volume business with a high per unit cost. Many NewSpace business models are driving volumes several orders of magnitude higher than traditional norms.

The challenge is to be able to effectively scale and still maintain quality. Business models are built based on certain cost estimates—typically ranges of cost estimates. In order for the business model to work, cost targets must be achieved. This drives the need to control development, product, and deployment costs across the enterprise.

The consumer electronics industry has certainly shown that in order to sustain a strong business model companies must continuously innovate. One of the great elements regarding relatively short orbital lifetimes is that they provide the opportunity to update technology much more often than has traditionally been the case in space.

However, that same advantage is also provided to competitors—companies must continue to innovate in order to ensure your business model remains compelling and competitive. All of this innovation must be delivered while controlling costs and maintaining schedules. Further, in most cases, the task is fundamentally difficult. Space is difficult. This IS rocket science. Adding commercial and MAG business goals compounds that challenge.

Overcoming these challenges and delivering continuous innovation requires high quality technical talent. Experienced technical professionals and new graduates are in extremely high demand. Attracting and retaining good engineers and technicians is a big challenge across all segments of high technology. In many cases, this will dictate geographic business locations and often impacts key decisions.

Electronic Design + Test Strategy Considerations

Electronic design and test are integral elements of spacecraft development and deployment. As NewSpace drives change, the philosophies, strategies, processes and requirements associated with electronic design, development, production, test and measurement change as well.

In particular, the volume, cost and schedule challenges of NewSpace drive a different approach than traditional space. Use of best practices from the commercial electronics sector, efficiently aligned with the unique needs of space, is essential to a successful and sustainable NewSpace business model, whether in the MAG or commercial environs.

The basic construct of the electronic product development cycle is quite common across industries:

Key elements that distinguish different industries are the definition of each stage, the criteria for moving between them and the rigor with which the process is followed. In low volume conditions such as traditional space, the lines between development, validation and production are often somewhat blurred.

Conversely, with the volumes of many NewSpace businesses, the lines need to be more defined in order to scale volume efficiently. As volumes increase it is particularly important to have clearly defined criteria for release to production.

Debugging design problems in production impacts cost and schedule and slows down the primary function of production, which is to ship products. Additionally, varying industries and companies have different approaches as to how much they use innovation cycle feedback. This loop is integral to meeting the business challenge of continuous innovation. Simulation and measurement tools to support this feedback mechanism are key.

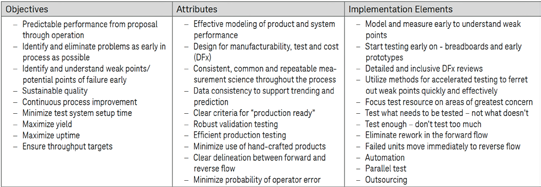

In order to achieve business success, specific design and test strategies as well as the processes consistent with your business model and business realities must be defined. Business considerations drive design and test objectives which dictate the attributes of the design and test process required to meet those objectives and, ultimately, drive a specific implementation approach.

Many of these items may seem obvious, while others may not be as clear. Even some of the more obvious ones can be overlooked in a challenging schedule-and cost-constrained environment. Several of the less obvious items and some that often get overlooked follow...

Business Considerations

Many factors impact the success of a given business model. Some of the key considerations relevant to the design and test strategy are:

• Functional, performance and physical requirements

• Timeline and market window

• Cost requirements

• Volume and throughput requirements

• Risk profile

• Future plans

• Core versus context

Documenting and tracking requirements may seem obvious, but oftentimes in schedule-driven developments, this critical element gets overlooked or pushed aside. This typically creates confusion between the designers and test developers and often results in schedule slippage.

A critical part of achieving business success is having a design and test process that aligns with your risk profile. Historically, the design, validation and test approach employed in the space industry was very different from that of the commercial electronics industry. Far and away, the highest priority of the process in traditional space was to beat the risk down as much as possible, often at the expense of schedule and cost—test everything, and test it a lot.

Almost by definition, NewSpace is willing to accept some level of risk. A key element of the test strategy is to define what risks are and are not acceptable—establish and document a risk profile.

For example, perhaps you are willing to accept a 5 percent failure rate over a two year period, and plan to mitigate this risk in the system design. A detailed assessment of risk will help drive the test strategy and process. The test process targeted at a 5 percent failure rate is quite different from one that targets 1 or 20 percent. Of course, one that targets 1 percent would achieve the 5 percent target, but may exceed cost and schedule targets.

Future planning is an important consideration as part of the process definition. Assess short, medium and long-term goals—do you plan to grow in volume? Do you plan to expand your product portfolio or increase complexity? If you expect your needs to change in the future, make these important choices now to help you adapt and upgrade over time.

A second key element that is not necessarily obvious, and is often overlooked in process definition, is the concept of core versus context. Core is that content which your organization is uniquely capable of executing better, faster or cheaper than an outside source. Context is everything else that is necessary for business success, but is not part of the core. The more you are able to focus on your core, the higher likelihood you will have for a successful and sustainable process.

Your process may be best served by outsourcing context items to enable more focus on core. For example, equipment calibration and maintenance is essential for business success in electronic design and production, but for many companies it is not part of their core. What is core and what is context, and what may change over time, is important to determine. The review of core versus context should be completed on a regular basis in order to maintain a tight focus on key differentiators as business conditions change.

Process Objectives, Attributes + Implementation

The objectives, attributes and specific implementation approach of a design and test process are tightly linked. As such, they often become blurred together. Critical is that attributes align with objectives and that the implementation aligns with the attributes and achieves the objectives. Table 2 below lists primary objectives, attributes and implementation elements.

No single implementation approach will fit every NewSpace business model. However, focusing on the items discussed above will provide the context to make the best implementation choices for a given business model. All of the items in Table 2 have some level of impact across the business model. However, each has primary impact in one of three broad categories—design robustness, volume enablement and cost management.

Design Robustness

Effective and accurate modeling is necessary in order to be confident that a given product or system concept will meet the requirements and align with the business model. The simulation tools used should support margin analysis and the ability to incorporate measured data. Improperly managed margins can add significant cost and risk to a program.

If margins are too tight, unnecessary costs are pushed down to subsystems and components. If margins are too loose, they could stack up unfavorably, leading to poor system performance or failure.

Simulation and models help properly manage margins for optimum performance and cost tradeoffs. Simulation and test data consistency throughout the process also enables trending and im- proved prediction over time. It’s key that the measurement science employed at each stage is repeatable and consistent with other stages.

Modeling will also provide early insight into the problem areas and potential weak points in the design. Problems caught early in the process are far less costly, both in terms of money and schedule, than problems found late in the process. Start testing early. Build breadboards and early prototype assemblies, particularly of the highest concern parts of the design, and perform rigorous testing on them.

Hardware-in-the-loop integrated with your simulation software and models increases fidelity of your system simulations. This enables higher confidence in advance of first “turn on” of the system as to whether the pieces are going to work or not.

Highly accelerated life testing (HALT), or highly accelerated stress testing (HAST), can be a most effective approach for early detection of design problems and infant mortality. The level and formality of HALT/HAST that is used should be consistent with the product and business model.

For example, in order to test the lifetime quality of electrical connections, a combined thermal and vibration environmental test can be done to add additional stresses. This may lead to the detection of fatigue or fracture that would normally take years to manifest itself as a failure. By doing a rapid test that might constitute some percentage of the lifetime number of cycles expected, you can catch issues without the need for extremely long test cycles.

Volume Enablement

Design for manufacturability, design for integration, design for test, design for quality, and design for cost are essential for a profitable business model. These DFx techniques are tightly related—consideration and review of these elements is critical early in the process. The reviews should include all of the key stakeholders—R&D, test engineering, production and quality. Early feedback on DFx issues will pay off in production with improved throughput and yield.

Clear and aligned criteria for “production ready” is also critical. Rigorous and broad testing and debugging of the design should be focused in development and validation phases. As you move into production, focus on the areas of greatest concern. Consider not testing or only sample testing the areas that have little cause for concern.

For example, if modeling and early testing has shown sensitivity to low temperature, but not high temperature, consider mainly testing at low temperature. Be certain, however, to test at a level that is consistent with the risk profile and potential failure modes.

In the production test process, there must be a clear distinction between forward flow and reverse flow. If a unit fails in forward flow, that unit must be removed and transferred into reverse flow in order to achieve throughput objectives.

When failed units remain in forward flow for debugging, they create a bottleneck that slows, or even stops, product shipments. Process automation is a powerful tool in a volume test process.

Automation brings significant advantages:

• Reduced test system setup and measurement time

• Reduced risk of test operator error

• Utilization—maximize usage of capital equipment

• Improved yields, reduced rework and re-test

• Reduced human attended test time

However, automation will typically incur additional up-front expense and initial setup time. The level of automation that is sensible will be dictated by several factors. Assess and determine what level of automation best delivers the target metrics defined above.

Parallel testing can take several forms—multiple channels, multiple measurement types, multiple units under test (UUTs), etc. The primary objective is to ensure throughput and asset utilization objectives are achieved.

Cost Management

Outsourcing is widely used in the commercial electronics industry. As discussed earlier, core versus context is an important consideration.

For those elements that are deemed to be context, outsourcing may be a viable alternative as such can provide advantages in process efficiency and overall cost. Additionally, outsourcing can help address the challenge of attracting technical talent, as contract resources may be available where permanent hires are not so readily accessible. Outsourcing is certainly not to be taken lightly, but should be considered as part of an effective business model.

When aligning the design and test process with the business model, one of the primary factors to understand is how they impact cost.

Primary contributors to cost include:

• Yield

• Test time and throughput

• Utilization

• Equipment cost

When computing the equipment cost, take a view of the total cost of ownership (TCO) of the process and the associated value delivered. Oftentimes, the equipment cost is viewed only in terms of the

initial purchase. TCO is key to understanding the real cost and associated impact on the business model. TCO is defined to be the total cost to own and operate a piece of equipment over its useful life.

Keysight has developed a TCO model for the industry that is comprised of the two core elements of capital expenses (acquisition costs) and operating expenses. Refer to reference [1] for detailed information on TCO.

As you define your electronic design and test process, work with a partner that can support your business as well as technical needs. Keysight offers the broadest portfolio of electronic design and test services and products to assist you from early design though production, deployment, operation and maintenance.

A KEYSIGHT Differentiator

Keysight has been the leading provider of electronic design and test solutions to the space industry throughout its history—initially as Hewlett-Packard and then as Agilent, and that tradition now continues as Keysight. Throughout that time, the company has also been the leading provider of electronic design and test solutions to the commercial electronics industry.

Keysight has a strong history of successfully applying lessons learned in the commercial electronics industry to the Aerospace industry, with a commitment to delivering electronic design and test products, solutions and services to meet the changing needs of the industries served. Leveraging the best practices from the commercial electronics industry to address the unique challenges of NewSpace is a key component of Keysight’s services, which include:

• Process analysis

• Calibration and repair

• Asset management

• Custom applications engineering

• Test system and process design and implementation

• Resident professional program—Keysight experts embedded with your team

• In-depth technical training

Enabling clients to receive the solution that best aligns with their business models is Keysight’s charter.

The firm’s EEsof electronic design automation software portfolio spans from low-level circuit design with industry leading Advanced Design System (ADS) to complex system level modeling with SystemVue. Keysight is the leading provider of electronic measurement instruments and software in nearly every significant category and a broad array of application specific test systems and automation solutions are offered.

Keysight is best known for high performance bench-top box instruments, with products offered over a wide range of price-performance: from basic products to fit tight budgets, to the highest performance to meet the most difficult measurement challenges. A broad portfolio of hand-held instruments, including the Field Fox hand-held combination network and spectrum analyzer, are available.

Modular instrumentation is also a major focus area, with a rapidly expanding portfolio in PXI, AXIe and USB form factors. Keysight’s software portfolio offers solutions that support our broad hardware offering with applications across industries and throughout the product lifecycle.

Industry-leading measurement science is employed across Keysight’s portfolio, delivering measurement and data consistency throughout the design and test process, regardless of product choice. For example, the same measurement algorithms are used in basic class CXA spectrum analyzers as in the highest performance class UXA. Those same algorithms are also employed in the PXI vector signal analyzers, 89601B vector signal analysis software and SystemVue system level design software.

Keysight is committed to enabling NewSpace business models including cost management. We offer a broad array of tools to enhance affordability and deliver superior total cost of ownership. Comprehensive upgrade capability and trade-in programs enable your Keysight solution to grow as your needs change.

Keysight software is downloadable expertise. From first simulation through first customer shipment, tools are delivered to your team whose needs range from acceleration of data to information to actionable insight.

• Electronic design automation (EDA) software

• Application software

• Programming environments

• Utility software

Learn more at www.keysight.com/find/software and also start with a 30-day free trial at www.keysight.com/find/free_trials

NewSpace is creating tremendous excitement in the MAG and commercial space industry. New companies are entering these various market segments and traditional companies are adapting to the changes.

Many completely new business models are emerging. Ensuring quality while dramatically increasing volume and reducing cost is difficult and requires a strong balance of commercial electronics and traditional space industries, combined with completely new discoveries, to realize the promise of NewSpace.

Keysight is ready to help you realize the promise of your NewSpace business model by bringing together the best of commercial and aerospace electronic design and test.

References

1“The Real Total Cost of Ownership of Your Test Equipment”, Bill Lycette and Duane Lowenstein, Keysight Whitepaper, p/n 5990-6642EN.

www.keysight.com/find/ad/www.keysight.com/find/satellite