Matt Tirman serves as the President of Satellogic and brings more than 20 years of experience in technology and aerospace from across the U.S. government and international markets. As President, he leads the operational execution of Satellogic’s strategy and business plan. Prior to this appointment, Mr. Tirman held the position of Chief Commercial Officer, where he began laying the groundwork for Satellogic’s early entry into the U.S. market.

Before joining Satellogic in 2021, Matt served as Head of Government at Descartes Labs, a leading provider of geospatial and multi-sensor analytics, where he revenue growth and customer delivery across defense and intelligence clients. His previous roles include Chief Commercial Officer at PlanetRisk, where he was responsible for delivering enterprise geospatial risk analytics and customized big data solutions to Global 1000 customers; Chief Executive Officer and founder of Access Global, a consulting firm providing executive management, sales, and business development solutions in foreign markets across EMEA and Asia; Vice President and Managing Director at Strategic Social, a technology and services firm operating frontier markets across the Middle East and North Africa that he helped grow to more than $40M in annual revenue before it was sold to Constellis in 2014.

Additionally, Matt has served as an analyst for the US Department of Defense on cooperative Research and Development and as a speechwriter for senior military leadership in Washington D.C. and Baghdad, Iraq. He holds a master’s degree in Defense and Security from Lancaster University and a BS in Political Science from East Carolina University.

Company update

Satellogic recently announced its redomicile to the U.S. with a new focus on expanding business within the U.S. market and Matt Tirman was appointed the President and is overseeing the firm’s U.S. strategy.

The U.S. government seems to be streamlining its processes for working with commercial

providers — are we likely to see governments relying on commercial operators more?

Matt Tirman

Matt Tirman

There is growing concern that the U.S. would lose its lead in spaceflight which opened the door for more contracts with commercial operations. What we saw this month was the U.S. Senate Subcommittee on Space and Science addressing the red tape with the regulatory framework called “Part 450.”

The United States Space Force (USSF) has been building a broader strategy for procurement of commercial services over the past year to ultimately have a “commercial space reserve” and the organization is working on a commercial strategy, or blueprint, as to how this will integrate commercial satellite services into routine military activities.

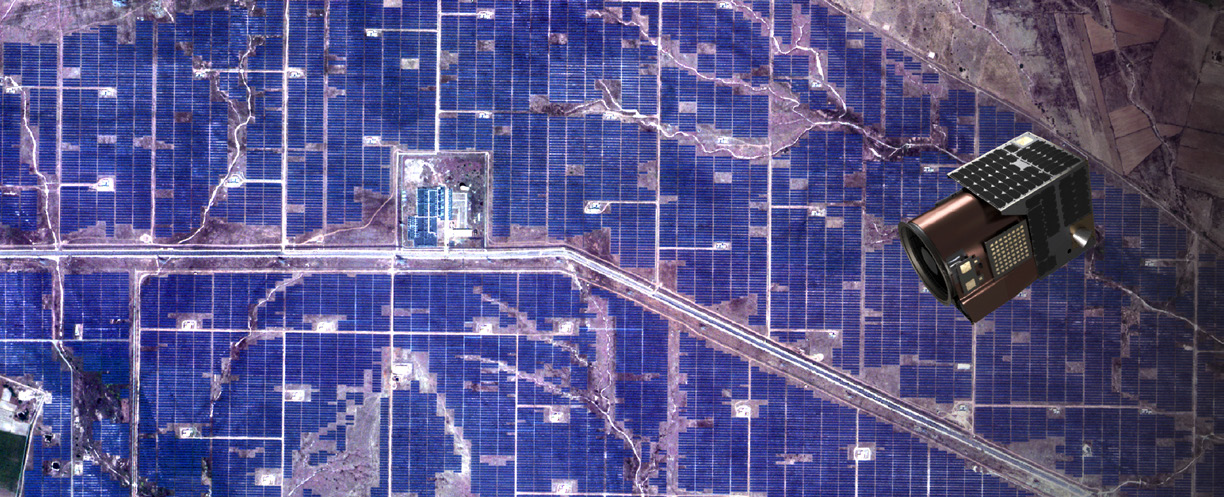

Commercial systems continue to prove as a critical partner to national capabilities. The expansion in various Earth Observation (EO) related contracts, such as the upsizing of the National Reconnaissance Organization (NRO) and National Geospatial-Intelligence Agency (NGA) contracts, and establishment of the USSF, are but a few examples of opportunities shaped by commercial providers.

Commercial satellite operators seem to be advancing rapidly — what applications are coming out of the commercial sector that are of most interest to government clients?

Matt Tirman

In 2022, a record number of commercial satellites were deployed — 2,325 — and the private sector is historically a stronger engine for innovation as well as for lower costs and increased capabilities.

When looking at reliability, flexibility and redundancy, one example would be the U.S. Army — a large user of satellite data — has a goal of decentralizing data sharing. Remote sensing is a priority for U.S. government use during national security emergencies. Also, exceptional, high-resolution, EO capture capability with the best geospatial data quality, all at the lowest cost, must be attained.

Another step in the process for Satellogic was filing for a National Oceanic and Atmospheric Association (NOAA) license. How has that process been and what is the expected timeline for licensing?

Matt Tirman

We filed an application to license our constellation with NOAA as part of expanding business in the U.S. market to better position Satellogic to compete for U.S. government and allied contracts.

Licensing has historically been a lengthy process; however, NOAA’s CRSRA group has significantly improved the time to obtain a license by 70% as a part of their efforts to streamline and keep pace with industry innovation.

Earlier this year, we saw the Federal Communications Commission (FCC) launch the Space Bureau to improve coordination among agencies and commercial providers to make it easier for new companies to obtain the authorizations they need to enter the market. We anticipate licensing prior to the end of 2023.

Will the redomicile change operations and what is the expected timeline?

Matt Tirman

We plan to complete the conversion during the first half of 2024 and this will be paired with our granted NOAA license. This will enable Satellogic to start manufacturing in the U.S., thereby expanding our manufacturing capacity and accelerating our aim to deliver daily, global remaps.

Satellogic already has a GEOINT contract in the works – what will that focus on and how was organized pre-NOAA license?

Matt Tirman

Through our federal partner network we connected with a variety of U.S. government projects.

Your Asset Monitoring and Constellation-as-a-Service (CaaS) businesses have gained momentum, contributing to a 33% growth in revenue for the first part of this year — are there any changes here with the redomicile?

Matt Tirman

As we look to 2024 and beyond, our continued growth will be in Asset Monitoring, Constellation-as-a-Service, and our Space Systems — which we anticipate will contribute considerably.

There are some 133 commercial space companies that provide their services to the U.S. military — none of which have had automatic protection provided by U.S. Space Command. Are there any concerns that your spacecraft could become a target by non-allied nations?

Matt Tirman

The U.S. intelligence community and DoD are increasingly reliant on commercial satellites for imagery and other critical data. Since Russia’s invasion of the Ukraine, commercial space companies have provided critical intelligence and communications services to Ukraine and that nation’s allies, and Russia’s military has threatened to target commercial systems.

The U.S. is working to ‘better enable protection of commercial remote sensing space assets’ The NRO, the NGA and U.S. Space Command (USSPACECOM) recently signed an agreement to improve threat intelligence sharing with commercial satellite operators.

satellogic.com