Have you ever heard of the Battle of Marathon that occurred between Greece and Persia in 490 BC? The conflict where a messenger named Pheidippides had to run ~26 miles, to deliver the news of victory to the city of Athens?

Then there’s World War I (WW-I)— the global conflict during which soldiers had to carry radios weighing anywhere between 18 to 25 kilograms on their backs, in order to maintain a communication link with the base station or other units.

From the era of having to run on foot for delivering messages, to a time when soldiers can securely communicate over several miles in a matter of seconds using a hand-held device, military communication devices have seen a fair share of development and the era of smoke signals, semaphores, and so on in military communication has finally been brought to close, thanks to by tactical radios.

The use of tactical radios in the military has a history that dates back to as early as WW-I and, although the operating principles have remained consistent, tactical radios have themselves become much far more advanced since their initial days of use. From spark transmitters (used during WW-I) that required horses for transportation to the battlefield, to hand-held devices that barely weigh half a kilogram, tactical radios have penetrated all three horizons of warfare, those being ground, marine, and airborne.

Though equally important in land, marine and airborne operations, the demand generated for tactical radios is higher from the ground forces as compared to the other two environments and that can be attributed to the following factors.

First, for every major military power save for the United States, the number of armed personnel in the Army is several orders higher than that of the Navy and the Airforce. Secondly, in times present and the past, land forces have had to engage in war-like events more frequently than the other two fronts.

The difference in demand can also be better understood by looking at some numbers from a report on ground tactical radios market, published by Straview Research, that states more than 65% of the demand for tactical radios in terms of volume is derived from ground-based platforms.

Another reason why numbers are higher for ground-based platforms is due to ground tactical radios also possessing fixed communication systems that are installed at different base stations on land, as opposed to airborne and naval applications where the systems must either be deployed in a vessel or an aircraft.

The Frequency Palette For Tactical Radio

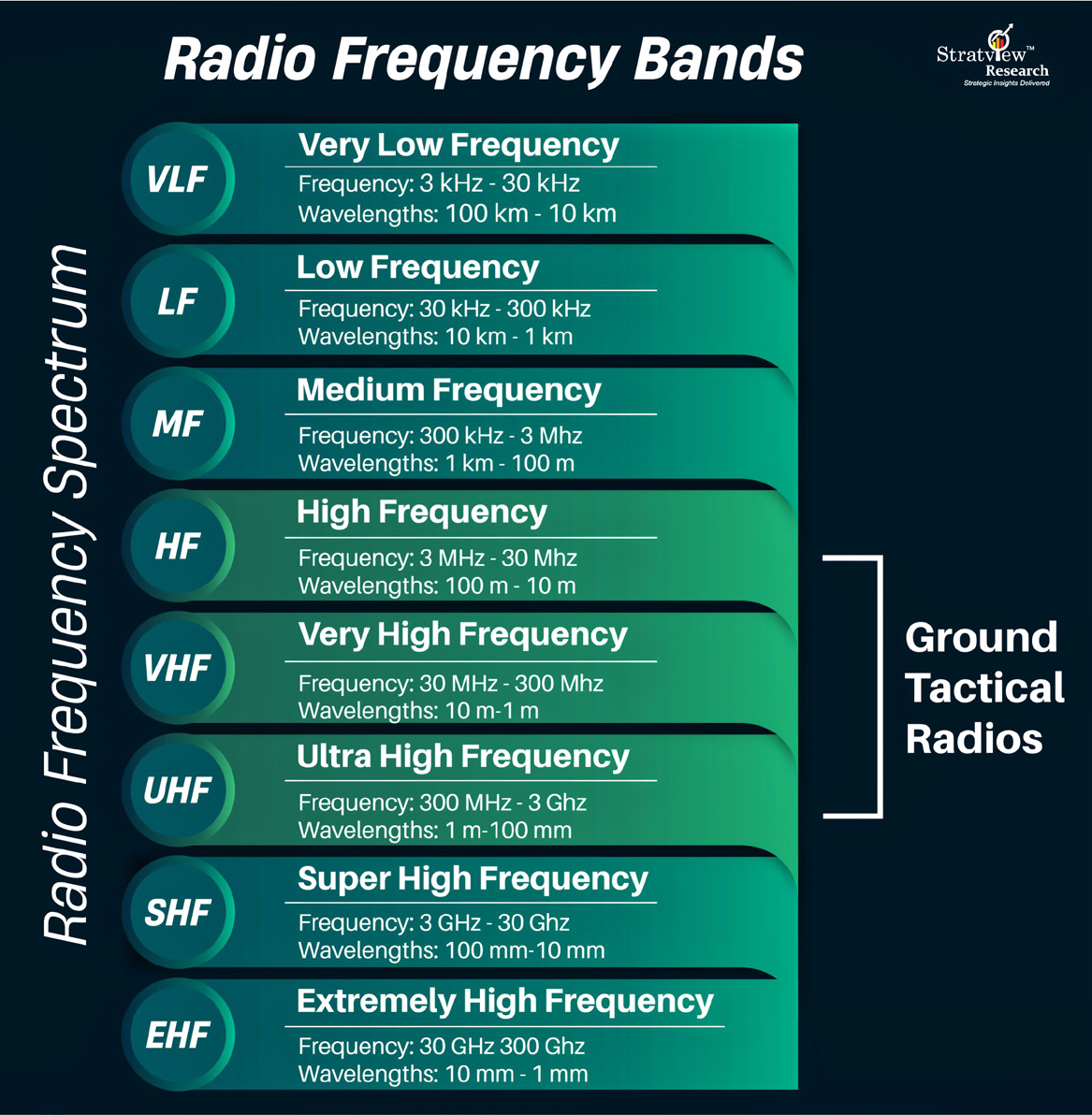

Figure 1. Radio spectrum and preferred bands for tactical radios

Despite the differences in operational requirements, the preferred band for all three tactical radio platforms is the VHF/UHF band. As known already, the radio spectrum ranges from as low as - .003.MHz. (Very Low Frequency — VLF) to as high as – 300,000 MHz. (Extra High Frequency — EHF), and is segmented into several different frequency bands.

Directly in the middle of this spectrum are the high frequency (HF -3 - 30 MHz.), very high frequency (VHF - 30 - 300 MHz.), and ultra-high frequency (UHF - 300 - 3,000 MHz.) bands, which are also the three most common bands used in tactical radios. Each of the suitable bands for tactical radio communication has its own perks. HF radios, for example, are vital for base station comms with each other over vast distances in the hundreds to 1,000s of kilometers.

Despite the ability to operate over the longest distance among the suitable bands, the HF band is not the preferred choice for ground-based tactical radio operations because of a number of reasons.

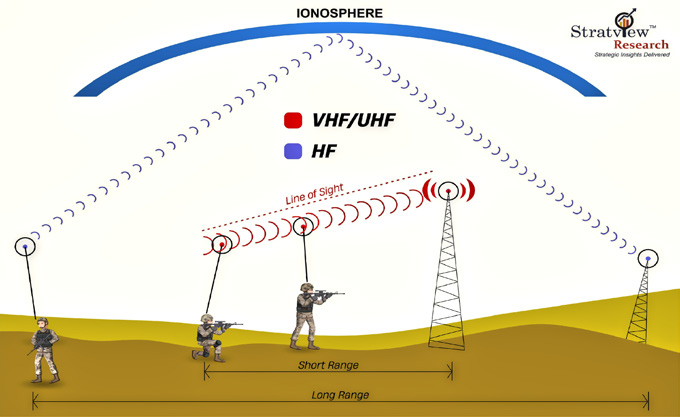

As ground-to-ground tactical operations are usually limited to a handful of closely, situated units, Line-Of- Sight (LOS) communication is considered more reliable. Even for longer-range applications, such as ground-to-air communication, HF waves are not the preferred solution as they are more susceptible to atmospheric absorption. The VHF/UHF band on the other hand, though considered ideal for short-to-medium range operations, prevails because of the ability to operate in LOS. Additionally,

the shorter wavelengths also make them less vulnerable to induced interference and jamming, especially when combined with Frequency-Hopping Spread Spectrum (FHSS) methods.

The prevalence of the VHF/UHF bands is extremely broad among tactical radio systems — more than 70% of the tactical radio equipment are designed to operate in this band.

There are however, a few downsides to selecting VHF/ UHF waves and one of the most problematic of them is reduced battery performance. The higher the frequency, the more intense the energy usage, and this implies that VHF/UHF devices are prone to shorter battery life when compared to HF devices.

Figure 2. VHF/UHF and HF operations.

Propagating Toward Improved Capabilities

Innovations and R&D in the field of defense are ceaseless. This is especially true when discussing equipment as crucial as tactical radios, which are responsible for, more or less, the overall communication on a battlefield. The price for outdated technology use by warfighters might be as disasterous as a lost mission or battle.

With the aim of providing armed personnel with the most reliable and secure equipment, leading defense contractors are currently focused on the following areas:

Software Defined Radios(SDRs)

To make tactical radios even more flexible and adaptable to changing mission requirements, the military has been implementing software to process various modulations, demodulation, and decoding, etc. for several decades in the form of ‘Software-Defined Radios’ SDRs. As a result,

SDRs have now become commonly used, unlike previously, owing to their high-performance, low-cost hardware and software, reduced size, increased bandwidth, and much more. Leading economies such as the U.S. are aware of such innovations and have been investing heavily in maintaining an up-to-date arsenal. For instance, the U.S. Army awarded an indefinite delivery (indefinite quantity) for the new Combat Net Radio (CNR) to L3 Harris Technologies in 2022 to modernize and secure the army’s network.

Integrated Tactical Networks (ITN)

The transmission of data and communications for hostile missions will see a step-change with the introduction of Integrated Tactical Networks (ITN). The function of ITNs is to incorporate the current tactical network environment with Commercial-Off-The-Shelf (COTS) components and transport capabilities, which will then provide numerous vital benefits to military forces, including improved situational awareness, decision-making, and survivability.

Among the early adopters of this technology is the U.S. Army. That organization is building an ITN by starting to integrate an existing enterprise network with other networks (tactical) to create a unified network. The network is expected to be operational by 2025.

Size, weight, and power(SWaP) modifications The ongoing need for reduced SWaP is driving the development of innovative tactical radios for use the battlefield. These radios demand increased functionality in smaller packages, even in body-worn equipment, on-field IoT sensors, or wireless sensors on unmanned sensors, or wireless sens aerial or ground vehicles.

One recent example of such equipment is the L3 Harris AN/PRC-158 radio, a unit that is compact, powerful, and modular and covers the full 30-2500 MHz. frequency range and is 30% smaller than similar products, according to the company.

Other disruptions

Moving quickly requires trust and moving forward with technology requires disruption. Additionally, disruptive technologies such as Artificial Intelligence (AI), Digital Twins, and so on, are shaping the future of defense systems. Governments are adapting these technologies to develop AI-powered radios and digital twins of radio systems. Giant firms such as L3Harris, Thales and others are already developing AI and digital-twin-technology integrated radios.

5G technology is another disruption. Though the applications of 5G in the military are not well defined as of this writing, the advent of 5G technology certainly opens many new doors.

Note that in terms of both military expenditures, as well as the pace of adapting new and advanced technologies, the U.S. is far ahead of all other countries. The gap is so huge that for the year 2022, the U.S. military expenditure ($877 billion) alone, is more than the expenditure of the next, top nine countries combined.

The presence of leading tactical radio manufacturers such as L3 Harris Technologies and Collins Aerospace also reduce the U.S. on other countries for technology or product. In the area of defense, the U.S. has already launched several initiatives to modernize radio systems via the Special Operations Forces (SOF) Tactical Communications initiative and the C3 (Command, Control, and Communications) Modernization Strategy by the Department of Defense (DoD).

Reports also suggest that the U.S. DoD is likely to purchase more than 100,000, two-channel, leader radios and 65,000 HMS Manpack radios, worth approximately $16 billion during the coming decade and that the U.S. currently owns >40% of the ground, tactical radios market.

What Do The Signals Suggest For The Future?

Ever since Russia’s invasion of Ukraine, mamy countries are now on high alert. The possibility of war has forced nation’s hands into increasing their annual defense expenditures and, as a result, in 2022, global military expenditures saw an all-time high of $2.2 trillion for product acquisition.

Communication equipment, such as tactical radios that are at the core of any country’s military capabilities, are bound to witness uninterrupted growth in the coming years as the nations of the world enhance their military capabilities.

SDRs and disruptive technologies such as 5G will unlock advancements in the field. In a time when armed forces across the world are focusing as much on electronic warfare techniques as they are on conventional warfare methods, one of the next significant challenges for defense manufacturers will be the development of Electronic Counter Measure (ECM) immune communication systems.

The journey of ensuring proper connectivity for the armed forces on the modern battlefield will be a most interesting one to observe. Over and out!

www.stratviewresearch.com

Author Aniket Roy is the Senior Business Analyst for Stratview Research Stratview Research is a global market intelligence firm offering a wide range of services including syndicated market reports, consulting, sourcing intelligence, and customer research. The company has a strong, experienced team of industry veterans and research analysts that possess a perfect blend of wisdom, knowledge and positive attitude. StratView Research has been serving multiple clients across a wide array of industries. The firm’s services cover a broad spectrum of industries that include Defense, Aerospace, Advanced Materials, Energy Chemicals and the Automotive industry. Research services at the global, regional as well as country level are offered as well as key regions that include Europe, APAC, NA, MEA, ROW. The company is a trusted brand in the research industry with the capability of commissioning complex projects within a short span of time with high level of accuracy. At Stratview, building long term relations with our clients is the key to success.